联系方式

more本类最新英语论文

- 2017-11-27美国会计学assignment:美国..

- 2017-10-28英国非执行董事与公司财务绩..

- 2017-10-28铁路财务会计

- 2017-09-09财务会计与管理会计分析方法..

- 2017-09-04澳大利亚assignment:面向生..

- 2017-08-16中国民生银行业务活动成本核..

- 2017-08-02accounting assignment:中小..

- 2017-07-31跨境并购的成败原因the suc..

- 2017-06-07无形资产及其减值和租赁英国..

- 2017-01-31留学生会计专业assignment写..

more热门文章

- 2010-12-24关于标准成本和预算编制理论..

- 2011-03-01留学生会计专业论文需求:t..

- 2011-01-07澳洲论文代写:澳大利亚会计..

- 2010-11-22研究基于活动的成本核算应用

- 2011-04-04留学生会计论文写作需求:r..

- 2014-09-18留学会计硕士毕业论文 浅析..

- 2010-05-19economics and accounting

- 2011-03-16auditing and taxation:th..

- 2014-09-20如何写好一篇会计学留学论文

- 2014-06-13british accounting review..

more留学论文写作指导

- 2024-03-31卡森•麦卡勒斯小说中..

- 2024-03-28美国黑人女性心理创伤思考—..

- 2024-03-27乔治·艾略特《织工马南》中..

- 2024-03-21超越凝视:论《看不见的人》..

- 2024-03-19《哈克贝利•费恩历险..

- 2024-03-13心灵救赎之旅——从凯利的三..

- 2024-02-22文学地理学视角下的《印度之..

- 2023-05-03英、汉名词短语之形容词修饰..

- 2023-02-07目的论视域下5g—the futur..

- 2022-07-04二语英语和三语日语学习者的..

凯恩斯的基本理论框架

论文作者:www.51lunwen.org论文属性:作业计算问题 Assignments:Questions, Math Problems登出时间:2016-04-01编辑:anne点击率:7625

论文字数:1058论文编号:org201604011049536185语种:英语 English地区:英国价格:免费论文

摘要:据凯因斯说,他认为利率不是由储蓄和投资决定的,这是所谓的古典学派所同意的,而是货币数量和货币数量的要求。

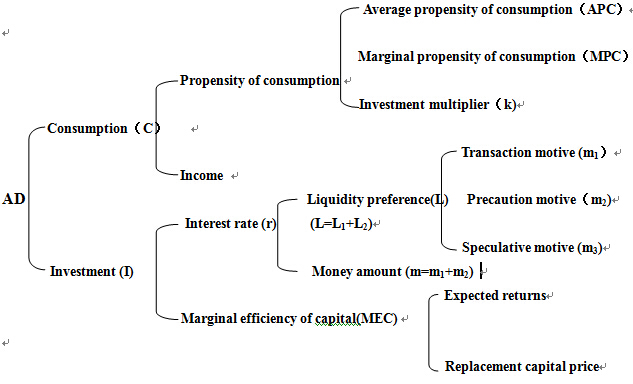

The framework of Keynes' basic theories can be demonstrated as follows:

据凯因斯说,总有效需求是由消费和投资决定的。为什么投资是关键的经济变量,投资可以改变很容易,另一方面,它是影响它,一些非常敏感的因素即利率和资本边际效率(MEC)。根据上述图表说明凯因斯的主要理论,流动性偏好和货币数量对流动性偏好的影响,这是由交易动机、预防动机和投机动机决定的,因此,资本的边际效率决定于预期收益和重置资本价格。众所周知,交易动机的货币因素、预防动机、投机动机、预期收益和资本价格的变化可以更换。让我们再到上面的图表,让我们分析影响投资的因素。

(1)利率。

事实上,实际货币供给量通常是由国家或政府控制的,这可以被视为一个外部变量。所以我们应该关注货币的需求。货币的需求也可以被称为流动性偏好,这意味着由于货币的使用弹性,人们倾向于在心理上保持财富,通过在固定期限内通过存款货币来节省利息收入。货币使用的灵活性满足了交易动机、预防动机和投机动机的需要。据凯因斯说,货币需求函数可以表示为:

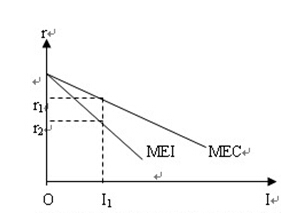

According to Keynes, aggregate effective demand is determined by consumption and investment. The reason why investment is the key economic variable is that investment can be changed very vulnerably, put another way, it is very sensitive to some factors affecting it, namely, Interest rate and marginal efficiency of capital (MEC). According to the chart above illustrating Keynes' main theory, Liquidity preference and money amount have an impact on liquidity preference, which is determined by transaction motive, precaution motive and speculative motive, so does marginal efficiency of capital determined by expected returns and replacement capital price. As is known, the factors of the money for transaction motive, precaution motive and speculative motive, expected returns and replacement capital price are changing susceptibly. Let's get to the chart above again, let's analyze the factors affecting investment separately.

(1) Interest rate.According to Keynes, he thinks that interest rate is not determined by savings and investment, which is agreed with by the so-called classical school, but currency quantity supplied and currency quantity demanded. As a matter of fact, the actual currency quantity supplied is generally controlled by the nation or government, which can be regarded as a external variable. So we should focus on the demand of currency. The demand of currency can also be called liquidity preference, which means that owing to the flexibility of currency use, people tend psychologically to maintain wealth through saving dead capital at the cost of interest income obtained by depositing money at fixed period. The flexibility of currency use satisfies the need for transaction motive, precaution motive and speculative motive. According to Keynes, money demand function can be denoted as:

L=L1+L2=L1(y)+L2(r)=ky - hr……………………………………………………………………①

In the function above, L,L1 and L2 are the actual demand of currency, if we adopt M, m and P to denote nominal money amount, actual money amount and price index, then we can get:

m=M/P or M=Pm………………………………………………………………………………②

So nominal currency demand function can be denoted like:

L=(ky-hr)P………………………………………………………………………………………③

Again, investment function is like:

i=e-dr……………………………………………………………………………………………④

When investment increases, the aggregate effective demand will increase also.

We can see from function ④ above, when interest rate increases, investment will decrease, according to Keynes, investment and aggregate effective demand vary in the same direction, to be specific, when investment goes up a percentage, the aggregate effective demand will increase the corresponding percentage. So the relation between interest rate and AD is that the volatilit本论文由英语论文网提供整理,提供论文代写,英语论文代写,代写论文,代写英语论文,代写留学生论文,代写英文论文,留学生论文代写相关核心关键词搜索。

英国

英国 澳大利亚

澳大利亚 美国

美国 加拿大

加拿大 新西兰

新西兰 新加坡

新加坡 香港

香港 日本

日本 韩国

韩国 法国

法国 德国

德国 爱尔兰

爱尔兰 瑞士

瑞士 荷兰

荷兰 俄罗斯

俄罗斯 西班牙

西班牙 马来西亚

马来西亚 南非

南非